Business Insurance in and around Albuquerque

Albuquerque! Look no further for small business insurance.

Almost 100 years of helping small businesses

Cost Effective Insurance For Your Business.

When experiencing the challenges of small business ownership, let State Farm do what they do well and help provide outstanding insurance for your business. Your policy can include options such as extra liability coverage, errors and omissions liability, and business continuity plans.

Albuquerque! Look no further for small business insurance.

Almost 100 years of helping small businesses

Customizable Coverage For Your Business

Whether you own a lawn care service, a bakery or cosmetic store, State Farm is here to help. Aside from fantastic service all around, you can customize a policy to fit your business's specific needs. It's no wonder other business owners choose State Farm for their business insurance.

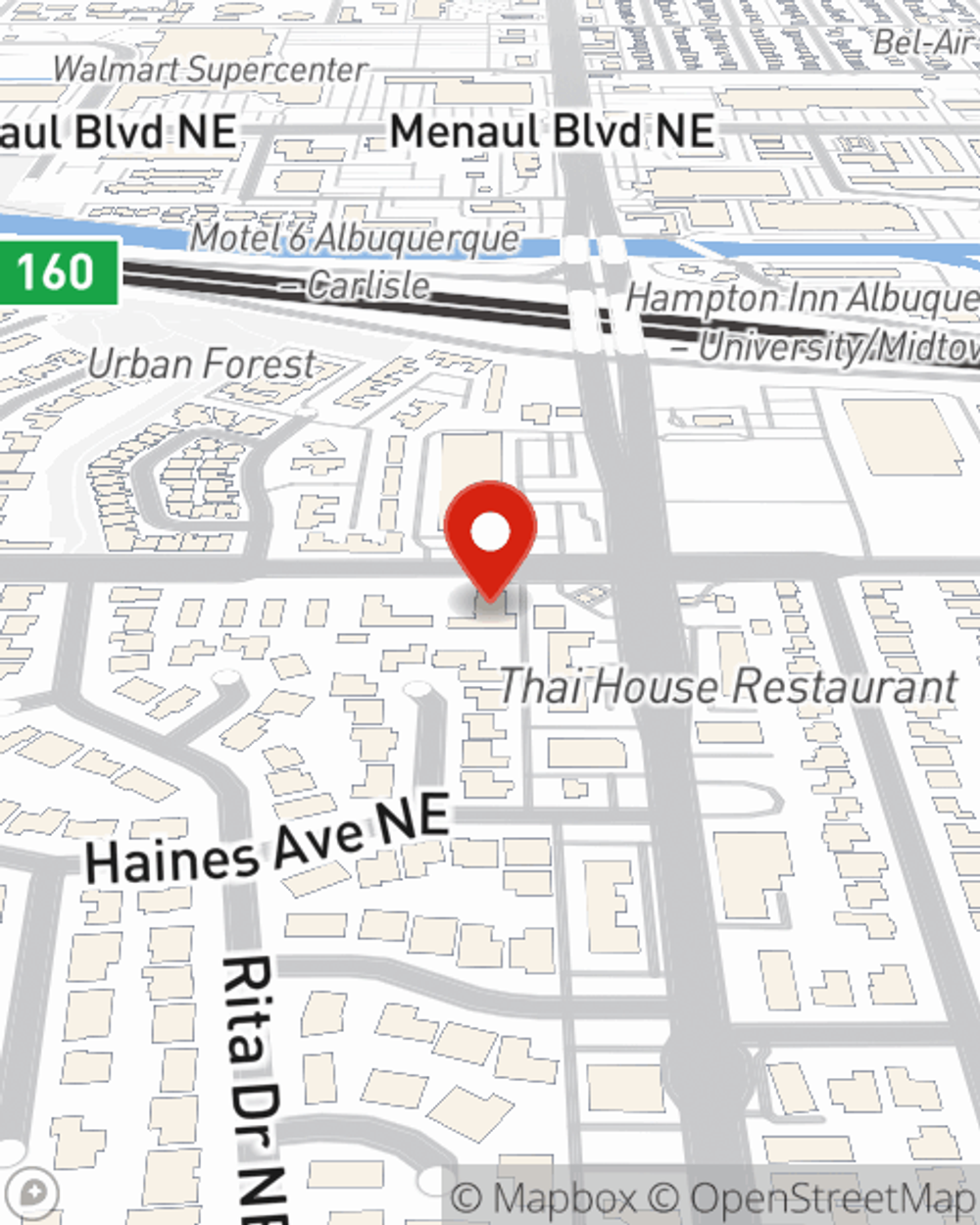

Ready to learn more about the business insurance options that may be right for you? Call or email agent Emily Rivera's office to get started!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Emily Rivera

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.